At StocksToTrade, we’ve been working with AI technology since the beginning — both in our technology and in our business operations. But something big changed when ChatGPT was made available to the public on November 30, 2022.

After ChatGPT was launched, people quickly became aware of the power of AI. And a significant number of them began to feel that they would be left behind if they didn’t learn how to use AI tools themselves.

StocksToTrade has always attracted a very tech-forward type of trader. That’s the premise of our software after all — putting everything you need to compete against other well-equipped traders in one place. Building AI systems that everyday traders can build into their trading flow was the logical next step.

Here’s how we did it.

What Is Artificial Intelligence in Trading?

Artificial Intelligence (AI) in trading utilizes advanced algorithms and machine learning techniques to analyze financial data, aiming to optimize trading strategies and achieve better returns. Here’s a breakdown of how AI impacts the trading landscape:

- Data collection: AI systems gather extensive financial data from diverse sources, including historical market data, economic indicators, company financials, news articles, social media sentiment, and more. This data forms the foundation for AI-driven analysis.

- Data preprocessing: The collected data undergoes cleaning and normalization to remove errors, fill in missing values, and prepare it for analysis. Preprocessing ensures the data is of high quality and suitable for training AI models.

- Feature engineering: AI utilizes feature extraction to identify key indicators, such as P/E ratios, volume, moving averages, and sentiment scores. These features help in understanding factors influencing stock price movements.

- Algorithm selection and model training: Various AI algorithms, including supervised learning models, reinforcement learning, and natural language processing (NLP), are employed. These models are trained using historical data to recognize patterns and relationships in market dynamics.

- Backtesting and live trading: After training, AI models are backtested on historical data to assess performance. Successful models are then deployed for live trading, monitoring real-time data to execute trades based on predefined strategies.

- Continuous learning and adaptation: AI systems continuously learn from new data and adapt to changing market conditions. This dynamic approach helps maintain the relevance and effectiveness of trading strategies.

StocksToTrade’s AI Technology

At StocksToTrade, we have integrated AI into our trading platform to provide cutting-edge tools for today’s market. Our AI-driven systems are designed to enhance user experience and offer sophisticated analysis tools, combining real-time data with predictive analytics to navigate financial markets effectively.

- Conversational, content-aware user interactions: We use OpenAI Chat API for developing conversational AI models. It empowers our applications to engage in dynamic, context-aware interactions with users. This not only enhances the user experience but also ensures seamless interaction with our products, making complex trading strategies more accessible and understandable.

- Fine-tuning APIs: A vital component of our machine learning operations, this API enables us to refine and customize AI models provided by OpenAI. This customization is essential for tailoring our AI to specific tasks and behaviors, aligning with our unique trading environment, and ensuring both performance and accuracy are optimized.

- Modern programming languages: The use of contemporary programming languages is key to developing our advanced AI-centric solutions. These languages offer ease of use, adaptability, and access to a wide range of modules, facilitating the construction, testing, and deployment of machine learning algorithms. They play a pivotal role in data handling, analysis, and predictive modeling.

- Cloud infrastructure: Our cloud infrastructure allows us to run our applications efficiently without direct server management, scaling automatically to handle operational demands ranging from minimal to massive. This infrastructure is integral for managing APIs, handling significant data traffic, and processing complex tasks. Additionally, it streamlines our deployment process, ensures the reliability of our services, and offers a cost-effective solution for large-scale database management.

Benefits of AI in Stock Trading

AI in stock trading is redefining the landscape of the financial markets, offering a multitude of benefits that enhance trading strategy and decision-making. Here’s how AI is transforming stock trading:

Improve Accuracy and Reduce Research Time

- AI-powered algorithms automate research processes, significantly saving time for investors and providing expert advice effortlessly.

- A study indicates a 10% increase in productivity with algorithmic techniques, owing to the use of historical financial data that improves the quality of guidance and reduces errors.

- AI solutions in stock trading systems utilize sentiment analysis to identify market trends and swings by analyzing news and social media, thereby forecasting patterns more accurately.

Enhanced Data Analysis and Algorithmic Trading

- AI algorithms process vast amounts of financial data in real-time, enabling investors to make data-driven decisions. This surpasses traditional stock analysis methods, capturing a broader spectrum of information.

- Algorithmic trading, powered by AI, executes trades at high speeds and frequencies, exploiting market inefficiencies and managing risks more efficiently.

- AI’s ability to quickly analyze large datasets and extract valuable insights impacts investment strategies, providing access to complex strategies previously available only to institutional investors and hedge funds.

Cost Reduction and 24/7 Market Monitoring

- Traditional investment firms often rely on extensive teams of brokers and analysts, whereas AI solutions can automate repetitive tasks, reducing long-term overhead expenses.

- AI algorithms work continuously without breaks, ensuring uninterrupted stock market monitoring, which is essential for high-frequency trading and managing market volatility.

Fraud Detection and Advanced Investment Strategies

- AI systems in the stock market excel in risk management and fraud detection, identifying unusual trading patterns and potential market manipulations faster than human intervention.

- AI-driven investment platforms offer personalized investment portfolios based on individual risk tolerance and financial goals, expanding opportunities for a wider range of investors.

Risk Management and Portfolio Optimization

- AI models, trained on historical market data, are adept at risk assessment and portfolio management, helping both retail traders and fund managers make more informed investment decisions.

- Continuous learning and adaptation of AI systems ensure relevance and effectiveness in changing market conditions, aiding in portfolio optimization and achieving financial goals.

Unique Advantages of IRIS Analytics, Our AI Trading System

IRIS works by evaluating company symbols using a proprietary scoring method that blends mathematical technical analysis with our patented machine learning models. This dual approach, enhanced by AI precision, allows for a higher level of analytical accuracy and objectivity.

In addition to generating detailed reports, IRIS features a robust periodic newsletter generation capability. This feature combines our proprietary screening technology with IRIS’s report generation power, offering users insightful watchlist newsletters. IRIS represents an innovative step in swing trade reporting, combining technical analysis with AI-guided scoring to provide an unmatched level of market insight and convenience.

It Isn’t Automated Trading

IRIS is far more than just a trading algorithm. It’s an AI system that leverages a Large Language Model (LLM) to process, analyze, and determine opportunities from a multitude of data points, including financials, company fundamentals, pattern recognition, and so much more. Imagine a tool that can simulate the thought process of experienced traders like our StocksToTrade human traders, but in a fraction of the time.

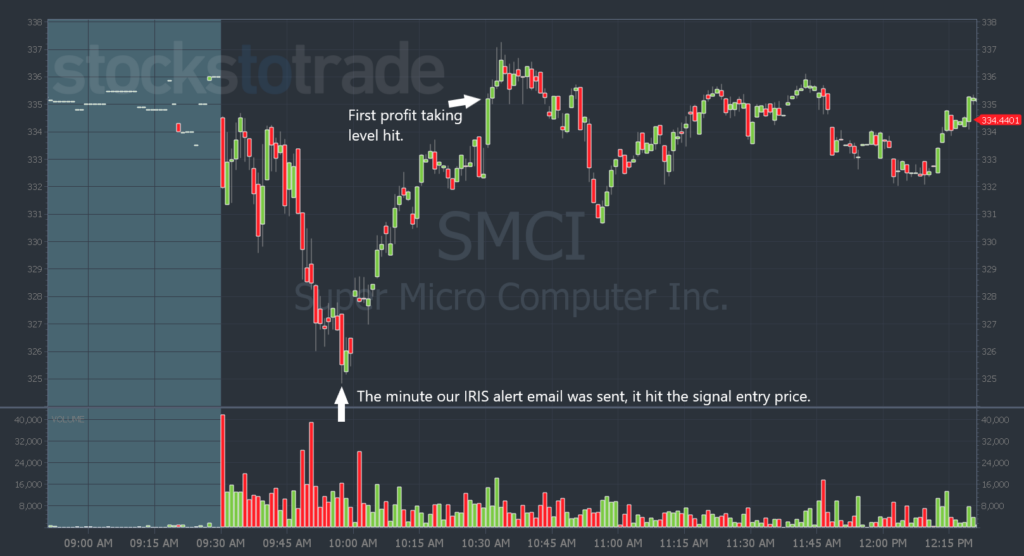

The IRIS reporting system uses artificial intelligence to create comprehensive, digestible reports within minutes — tasks that could take a trader days to accomplish. Additionally, when combining IRIS with our cutting-edge, real-time screening technology, our upcoming IRIS Alert System is able to generate a watchlist of opportunities after market close every single night, presenting you with the most promising swing candidates. This research and analysis process would take a trader years to learn.

Blood, Sweat, Tears, and Lots of Cash

Now, let’s talk a bit about the blood, sweat, and money that went into bringing IRIS to life. We’ve invested over a million dollars in research and development to create IRIS and all the systems that support it, and we continue to spend over $100,000 a month to access exclusive market data and run the infrastructure. This is something that is only available to very few companies in the world.

What makes IRIS truly unique is the combination of the richness of our data, our proprietary systems, and our vast experience in creating trading tools, AI, and new technologies. Our passion for innovation sets IRIS apart from any other product in the fintech industry.

Our Other AI Products

IRIS Analytics isn’t doing all of the heavy lifting on its own. We’ve also developed separate systems that deliver the AI-backed insights that IRIS builds its trade ideas through.

News Sentiment Analysis

At the heart of our robust backend infrastructure is the News Sentiment Generator, a sophisticated AI tool designed to analyze and interpret the sentiment in financial news articles. Utilizing advanced AI technologies, including the OpenAI Chat API, this tool is adept at extracting key patterns and insights that can significantly influence market behaviors and trading decisions.

The process behind our News Sentiment Generator involves meticulously crafted instructions to guide the AI, ensuring the data is cleanly processed and accurately analyzed. This results in a detailed sentiment analysis, providing our users with a nuanced perspective essential for making informed trading decisions. It’s a prime example of leveraging AI to transcend traditional news analysis methods, offering users a deeper understanding of market news implications.

AI Language Stock Screener

The AI Language Stock Screener at StocksToTrade is a testament to our commitment to pioneering AI innovation in trading. This tool, leveraging OpenAI’s Fine Tune API, creates a customized language model tailored to screener-related queries.

We have meticulously developed a proprietary dataset, ensuring robust and accurate model training and testing. The screener, post-training, uses the OpenAI Fine Tune Completion API to process prompts and deliver context-specific results. This integration with our real-time screener service results in a state-of-the-art, AI-powered stock screener, adept at interpreting user inputs and promptly returning matching stocks or live screener data.

The AI Language Stock Screener is more than just a tool; it’s a reflection of our dedication to harnessing advanced AI technologies to enhance user experience and democratize access to complex trading information, empowering investors to find viable investment opportunities efficiently.